Year-end closing deadline approaching, a step-by-step guide. Are you ready?

The year-end closing is a challenging process for the entire accounting department. The accounting team has to put in extended…

Running a startup or business in Switzerland requires efficient financial management. To streamline your accounting processes and manage finances, it’s essential to leverage the right accounting tools. In Switzerland, there is a range of accounting software options available, including both paid and free solutions. Even for experienced companies, it is not easy to make the right choice. To help you take informed decision and choose the smart accounting software, this article will provide you insights on:

Here are key considerations to keep in mind when comparing accounting software in Switzerland:

Cloud-based accounting software offers many benefits, such as lower costs, automatic updates, easy access, and better connectivity. However, some businesses may prefer local software for security or customization reasons.

Basically, a suitable program should provide all the necessary functions that are necessary for accounting. Some of the below features are most commonly available in accounting software. Depending on the size, industry and legal form of your business, you may have different requirements for your accounting software.

API stands for Application Programming Interface. With an open API interface your accounting software can connect with other systems, applications and solutions, such as liquidity planning, expense management, or credit card billing. This can help you enhance your accounting system to leverage use of the third-party apps and benefit from advanced features offered by such apps to help streamline process, save processing time for repetitive tasks, deep insights through interactive dashboards and reports etc.

Accounting software can vary widely in price, depending on the offered features, number of documents, transactions, employees, scope and quality of the service. You should compare the prices of different software and see what they offer in terms of functionality, support, and security. You should also consider the value that the software can bring to your business in terms of efficiency, accuracy, and insight.

You should look for software that meets your specific needs and offers the required features.

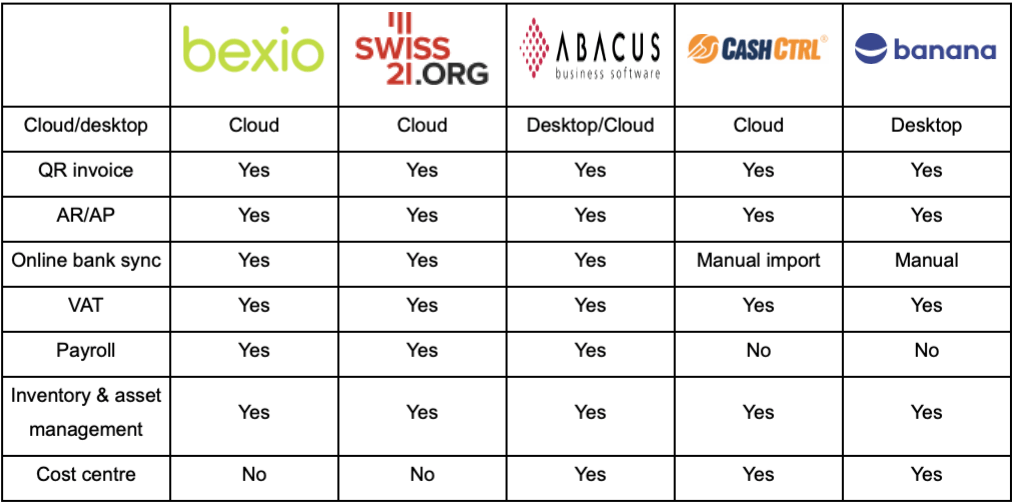

To help you with your comparison, here are some of the best known and best rated accounting software in Switzerland for startups and SMEs:

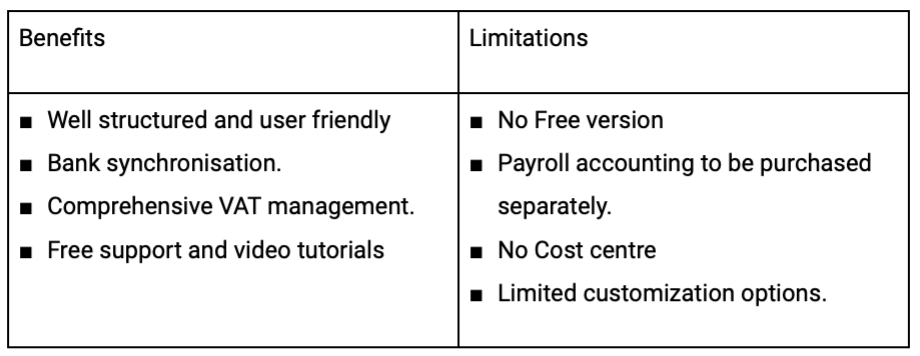

Bexio is one of the most popular cloud-based business management software designed specifically for small businesses and startups in Switzerland . In addition to accounting including accounts receivable and accounts payable, the starter package also includes functions for contact management, quotes ,QR invoice, e-banking and product management. Additional functionalities such as payroll accounting or an online store can be licensed as an option. The Pro versions then also include modules for time recording, warehouse management and a telephone legal information service. Bexio has a minimalistic but very modern look. The good structuring of the software as well as the easy possibility to collaborate with fiduciaries allow for efficient work and transparency It offers invoicing, expense tracking, financial reporting, and VAT management, making it an all-in-one solution for Swiss startups.

Here is a link to the Price plan and detailed features offered in each plan.

Abacus Research AG partnered with Swiss21.org for marketing of its software for small companies. Cloud based accounting application developed for this purpose is called Abaninja. The free version is available for a certain number of customers and transactions but it does not serve much purpose as it restricts basic essential features like customization of the chart of accounts.

Pro version, which starts from CHF 21 per month and the advanced features costs CHF 42 per month. It includes QR invoice for CHF invoices only, VAT, payroll accounting for a limited number of employees, multicurrency, online banking, time recording and debit and credit cards for a limited number of transactions. It covers all the important aspects of a modern and reliable accounting solution and comes with a fresh design. AbaNinja is functionally limited, and the navigation is simple and understandable, which makes it suitable for beginners. Further, it facilitates and gives an option to connect with 70 banks.

Here is a link to a detailed Price plan for quick reference.

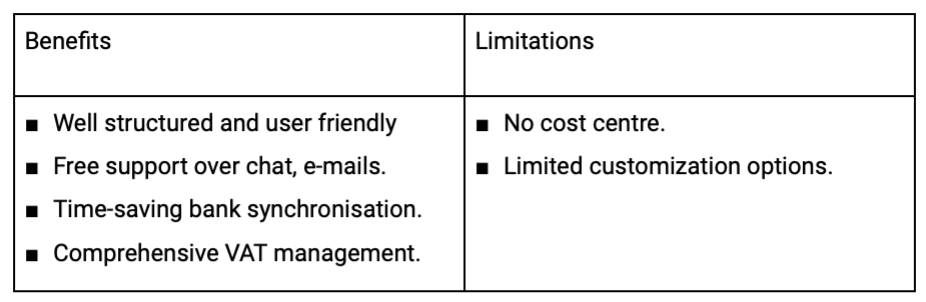

AbaWeb is a cloud-based software that simplifies and optimises the collaboration between companies and their AbaWeb service provider (e.g. fiduciary or sales partner). AbaWeb allows you to individually combine Abacus software modules on a subscription basis according to your needs.

It offers more possibilities than Abaninja, the basic package also costs from CHF 21 per month. However, modules such as payroll accounting, orders or e-banking must be purchased separately. The basic package also includes the cash flow statement. API extensions are available so the CRM can also be integrated into Abacus, the fixed asset accounting can be managed. Option to customize the internal communication and workflows as per business needs in the software. Budgeting, costing and financial reporting can also be managed. It is suitable for medium-sized companies who require advanced features, automation and integrated ERP.

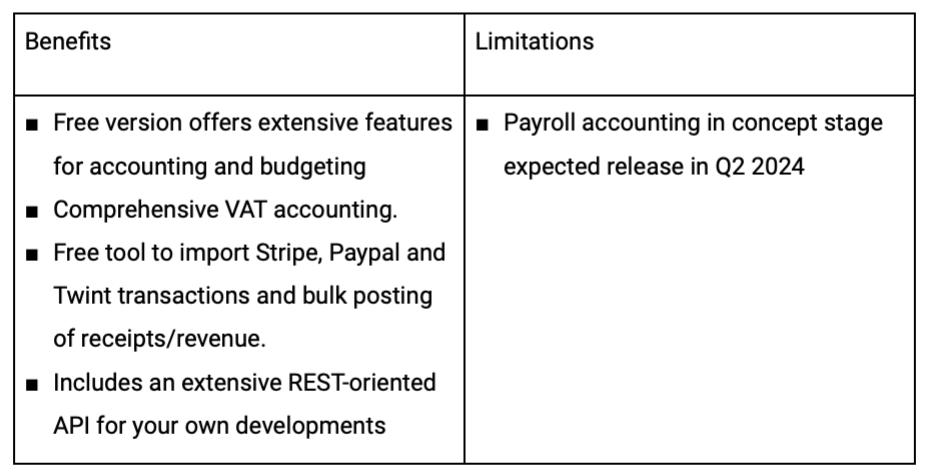

Cashctrl is a cloud-based accounting software for small and medium businesses, freelancers and associations. Free version for single user can handle basic book-keeping, QR invoices both CHF and EUR (Giro code), Accounts receivable/payable, VAT, budgets, inventory and asset management and provides basic reports for startups and small and medium businesses. Paid version further offers below features:

Pro version costs CHF 340/year. For the enterprise version you have to contact their sales team for a quote. Here is a link to a detailed Price plan for quick reference.

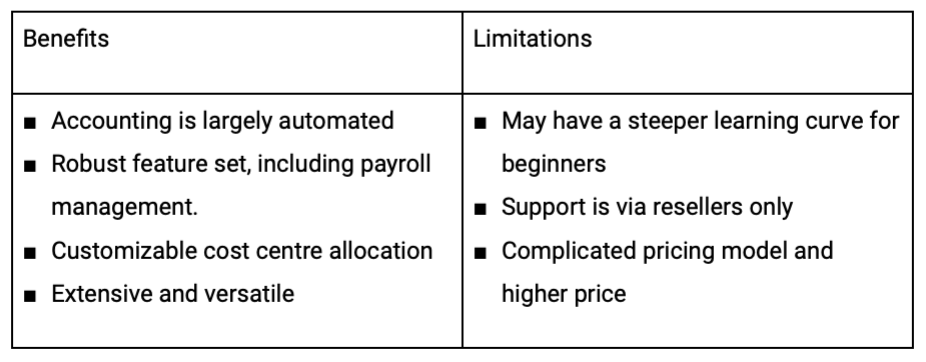

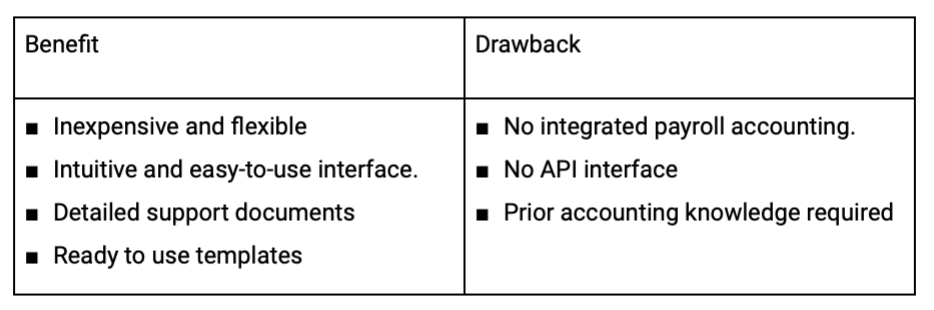

Banana Accounting is a user-friendly accounting software widely used by startups in Switzerland. The company has been known in the market since 1990. It is desktop based software. It offers bookkeeping, QR invoicing, contact management, financial analysis, VAT administration, foreign currencies, inventory management and fixed asset registers making it suitable for startups with basic accounting needs.

The software does not offer any integration or interface to other programs. However, manual import options are available. Direct telephone and e-mail support available for subscribers of advanced plans.

Mobile application introduced recently for subscribers of advanced plans allowing them to access their data on the go.

Free version is available with limited features and support, Pro version costs CHF69/year. Advanced version is available at CHF 149/year. For the latest update, you may refer to a detailed price plan and detailed offerings on their website

Selecting the right accounting tool is crucial for startups in Switzerland. Each of the mentioned accounting tools offer a set of features suitable for different business needs. By leveraging the information provided in this article and the comprehensive comparison chart, you can make an informed decision that aligns with your startup’s needs and budget, helping you effectively manage your finances as you grow your business in Switzerland.