🔥The Seed Funding Struggle: How to Navigate Investor Pressure

🔥The Seed Funding Struggle: How to Navigate Investor Pressure Not long ago, a growing startup on the verge of securing…

The year-end closing is a challenging process for the entire accounting department. The accounting team has to put in extended hours to meet deadlines along with year end like annual wage statements, VAT returns, annual corporate tax filings. As a founder or CFO of the company, you are responsible to present the yearly financial statements giving a true and fair view to the board and investors. These statements also become a source document for annual filing of corporate taxes in Switzerland.

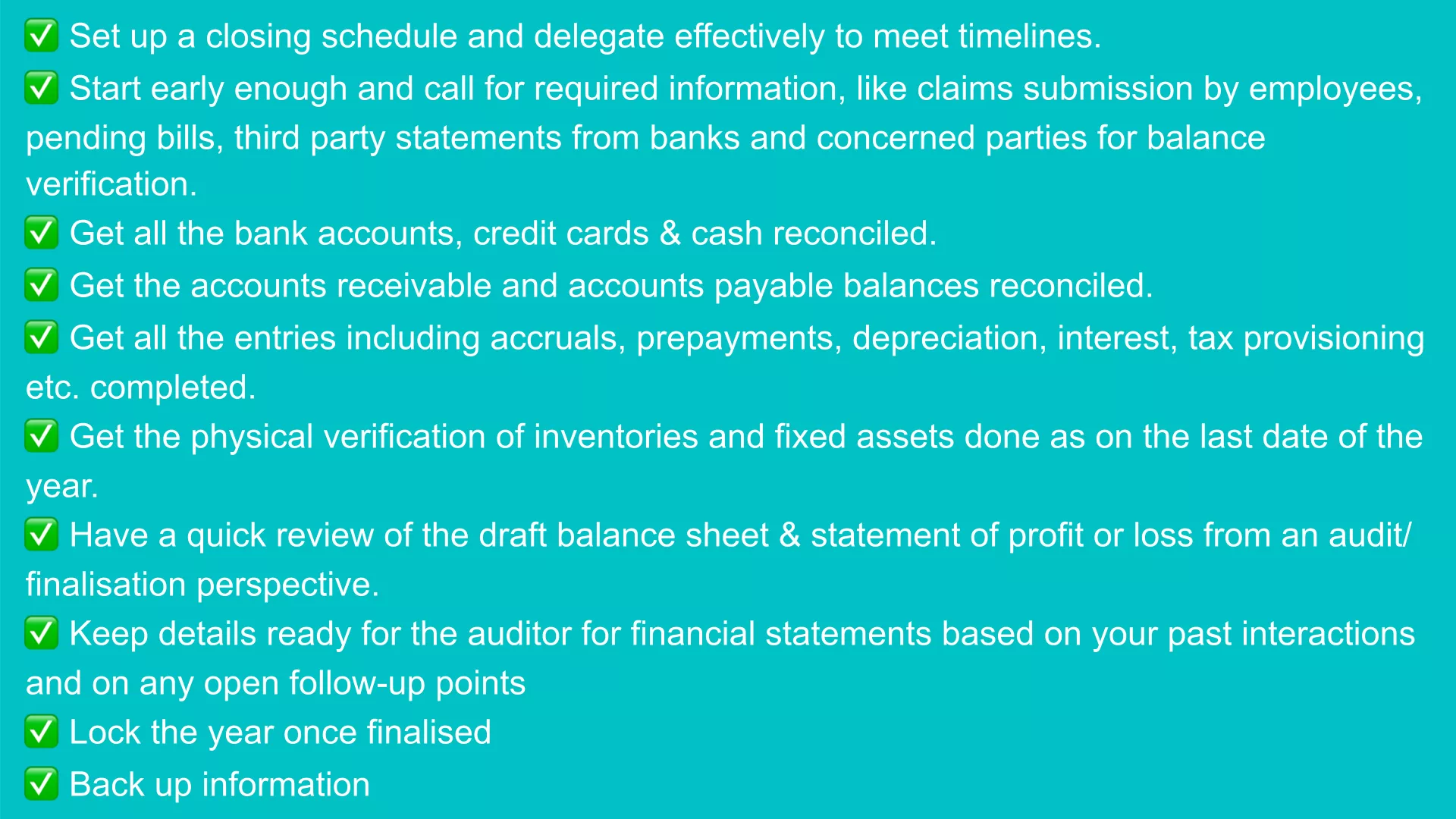

Make sure you check these steps off your year-end accounting closing checklist before the year officially comes to a close.

Below detailed guidelines will help you in set up, planning and close the year end in an efficient and effective manner:

List out tasks keeping in view of the following:

Organise this list, create tasks and action items with timelines and delegate wherever possible. Discuss this schedule with your team to incorporate their feedback and to clarify any questions or doubts they may have.

Your list will cover the following topics.

Request for inhouse desired information by sending emails to all concerned may be one month in advance (with follow up mails every 10 days till year end) clearly describing the desired actions and the timelines. For e.g.:

This exercise will ensure timely submission of the maximum information to the accounting team and its processing within the last month of year leaving you with more time to deal with other year end finalisation tasks.

Request for the third party statements as on the last date of the year like;

Create standard operating procedures, detailed checklists and templates customised as per needs of your business. This will help your team in quick and correct execution without missing out on any important steps and details.

Based on the information collated, get the accounting entries completed for all invoices for sale, purchase, expenses, cash, bank, credit card transactions pertaining to the year.

To finalise all income and expenses, start review of your draft P&L and cross check the following aspects if applicable to your entity. You have to pass the necessary closing and adjustment entries on the basis of your findings.

Pass the required entries for deferred revenue ,if any

If you are a SaaS company and have a revenue from subscription business, it needs to be ensured, revenue in P&L does not include any deferred revenue.

Revenue invoiced in the current year but belongs to the future year. For e.g. You have sold an annual subscription plan to a customer for $1200 on Dec 1, 2022 for the period Dec 1, 2022 to Nov 30, 2023.

Therefore, P&L for the year 2022 shall only reflect revenue of $100 pertaining to year 2022 and the remaining $1100 shall be accounted for as deferred revenue pertaining to next year. $1100. Following entry needs to be passed in the books and deferred revenue will appear as liability in the balance sheet:

Dr Revenue $1100

Cr Deferred revenue $1100

Dr Deferred revenue $1100

Cr Revenue $1100

Pass the required entries for unbilled revenue, if any

Unbilled revenue is revenue accrued but not invoiced due to one or more reasons.

For e.g. You are a SaaS company and you agree to provide your software to a customer for 1 year for $1200 starting on Dec 1 and you agree to invoice the customer at the end of every 3 months.

You will invoice $300 each quarter. However, at the end of December, you have unbilled revenue of $100. At the end of January, there is $200 unbilled. On February 28, you send an invoice for$ 300 to the customer and now unbilled is Zero and accounts receivable is $300.

Use a template for calculation of unbilled revenue.

Cross check revenue with VAT returns

Revenue reported in profit and loss statements should be reconciled with the revenue reported in VAT returns and valid explanation for variation if any shall be kept in records.

For e.g. mismatch with VAT returns due to sale of one of the product and service taxable at NIL rate. Get the entries done for rectification of errors or omissions found on such reconciliations.

Respective investment statements can be referred to cross check the interest income, dividend income, gain or loss on sale of any investments. Check if these are accounted for in books and numbers are matching with income reported in the investment statements. Complete the entries for fair value gain/loss as per applicable accounting standards.

Ensure that all purchases invoices pertaining to the year are accounted and provided for and input tax credit as per books is reconciled with VAT returns.

If you are dealing with products, you have to get the physical verification of stocks done at the year end and also reconcile closing values of stock as per cost records and as per physical verification report. Review with a view to ascertain if any provision is required for loss, shrinkage, obsolete stock.

Please ensure salaries, wages, bonus, social security benefits, pension, health insurance, accident insurance and relevant expenses pertaining to the year are accounted for and also reconciled with annual wage statements. Withholding taxes applicable on the same are correctly deducted and accounted for.

Please check whether the product development expenses incurred by your company is to be treated as revenue or capital expenditure. Review the stand taken in this regard with your professional consultant to have a correct classification that can be supported with facts and in line with applicable accounting standards. If the basis is questioned by your investors or tax authority at a future date, you’ll be able to respond swiftly with convincing facts and justification.

Sales expenses for events, gifts, sponsorships etc. have to be accounted for the year. For marketing expenses like google ads, facebook ads, it has been observed that facebook and google ads work on prepaid models i.e. amount is deposited with these companies as advance. The same is charged to these deposits on the basis of utilization i.e. actual display of ads during a period. Therefore, only the amount charged for the year in the statement shall be considered as expense. Unutilized amounts lying with google and facebook as on the last date of the year shall appear as prepayments on the asset side of the balance sheet.

Please check if invoices are received from the consultants as per respective agreements. If not, may follow and accrue the expenses as per terms of agreement for the year.

If invoices are delayed due to billing cycle or other reasons, these can be accrued on the basis of last month expense or on the basis of average expense for each head to reflect correct total annual expense for the year for respective expense heads in your P&L

If a business owns fixed assets like, building, furniture, computers, vehicles, plant & machinery etc. the fixed assets schedule as prescribed under applicable accounting regulations. The schedule shall be maintained, updated and depreciation needs to be computed on the basis of estimated useful life of assets and booked as per applicable depreciation rates .

If a business owned or acquired intangible assets like software, patents, copyrights, goodwill etc., amortisation of these assets need to be computed as per estimated useful life of each of these assets and needs to be booked as expense in P&L.

If there is a loan from an investor, bank or any other third party for business, refer to the latest terms of the loan. Cross check the applicable interest rate, repayment terms are correctly reflected in your interest schedule. Pass an entry for interest accrual as per final interest schedule.

Once all entries are complete and profit is finalised, prepare and review the tax computation and complete the entries for provision for tax

Start the review of your draft balance sheet and cross check the following aspects if applicable to your entity. You have to pass the necessary closing and adjustment entries on the basis of your findings.

Please cross check the balance as per respective bank statements and as per books. Keep reconciliation statements ready having the valid reasons for variations, if any. This exercise shall be done for all types of cash, bank accounts with post finance, credit cards, digital wallets, paypal, stripe, revolut etc.

Complete the pending entries, if any

Review the accounts receivable balance and ageing report .

Please update all entries for purchase or sale of fixed assets, resulting gain/loss and also depreciation and match the balance in books with fixed asset schedule.

Investment balance as per books and holding statements shall match if all the entries for actual gain/loss, interest, dividend, notional gain/loss are complete and correctly recorded.

Match the balances appearing on the balance sheet with respective income tax or VAT returns. Latest status can also be cross-checked from respective websites.

Refer to prepaid expense schedule having basis of booking and reversing of the prepaid expenses. It shall provide the detail of prepayment balance appearing on your balance sheet.

Review the accounts payable balance and ageing report.

Deferred revenue is revenue It appears on the liability side of the balance sheet and shall match with a deferred revenue schedule prepared for the said purpose.

Validate outstanding loan balance in books with statements received from respective banks or parties.

Once all the entries are passed and numbers are freezed for the year, lock the year so that no user could make the entries in the previous year inadvertently.

Keeping a record of all accounting data for future reference is critical to all businesses. Hence, don’t forget to add ‘backing up of important information’ into your year-end checklist. Adopt a reliable backup system that will protect your important accounting information on your phone or computer. You can also use cloud backup in case the local system is insecure.

After a lot of iterations, accounts are finalised and closed, don’t forget to run an update command for carrying final balances to next year.