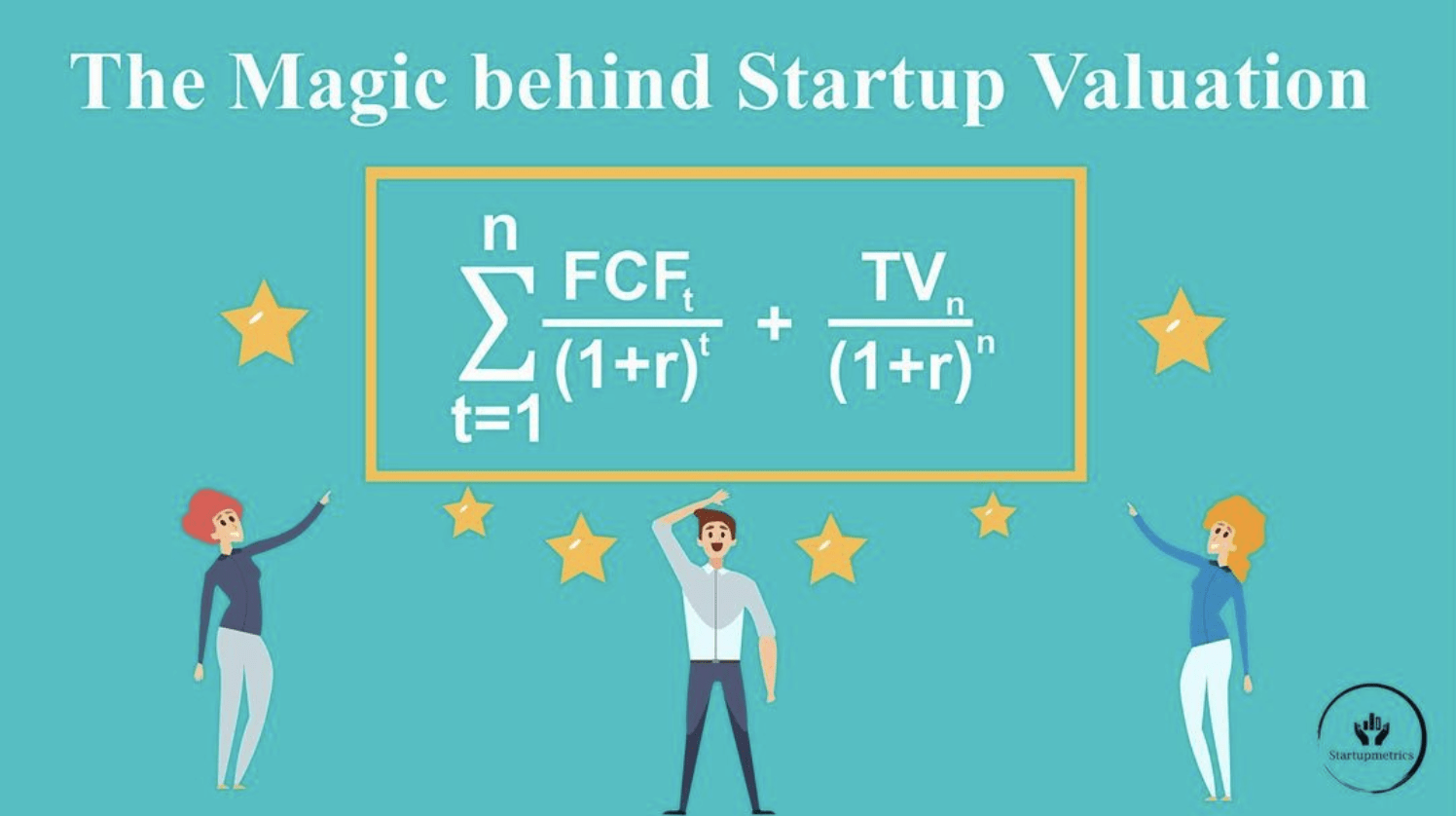

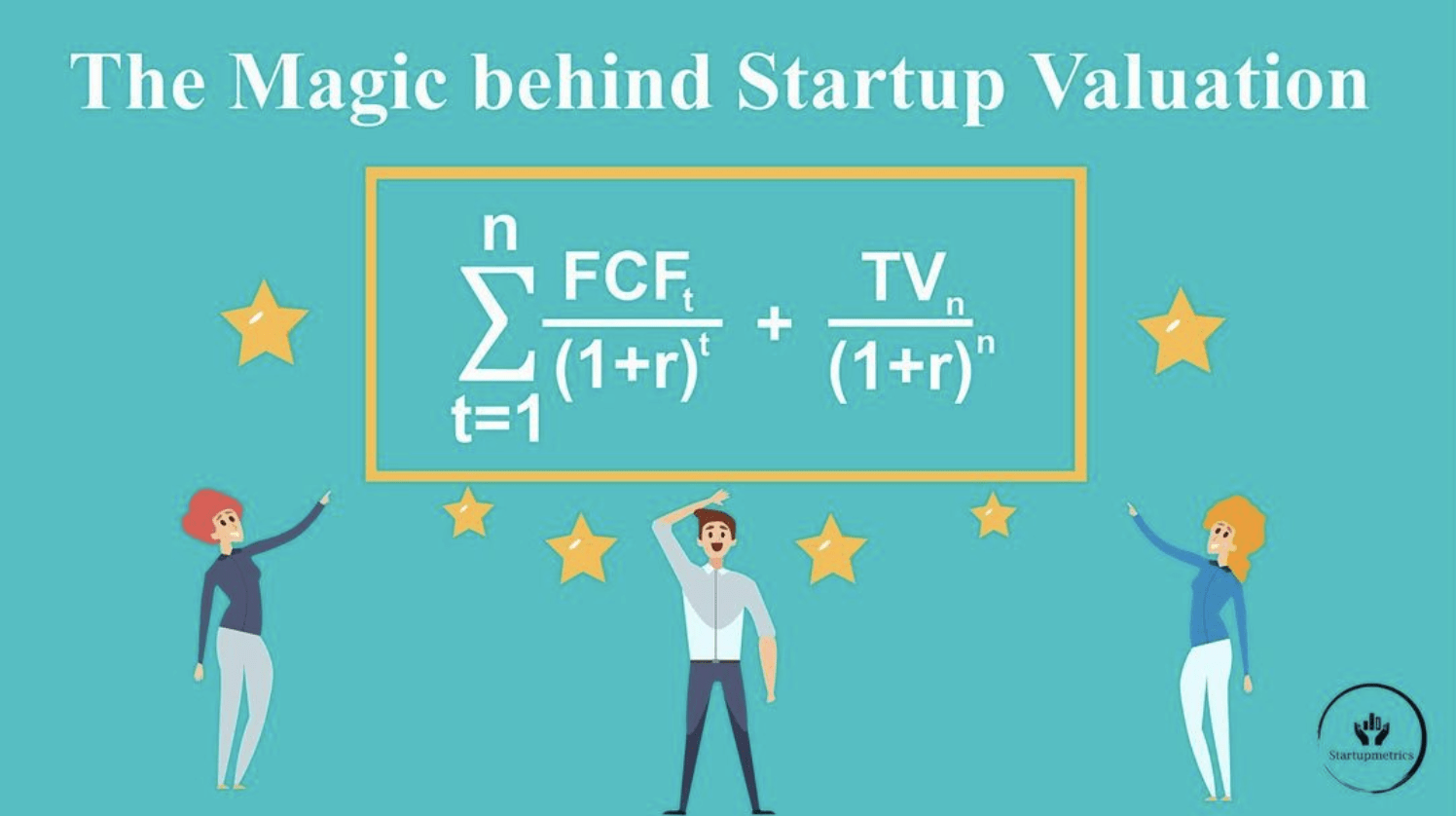

The magic behind startup valuation

15.02.2023

What determines the fair value of your startup and how can you objectively defend your startup valuation in transactions?

Many practitioners argue that startup valuation is more of an art than a science. We believe that valuing startups is simply a bit more difficult compared to valuing established companies. This argument is especially true for early-stage companies when little operational data is available.

The following three core elements, which are also shown in our illustration, define the value of any company.

-

Free cash flow (FCF)

-

Exit value (TV)

-

Return expectation (r)

These values are much easier to estimate for established businesses. But both business and market information can help you objectively estimate free cash flow, future exit value and expected market return by determining the respective underlying parameters. We list here the most important ones for early-stage ventures:

-

FCF

- Market potential

- Obtainable market share

- Sales cycle

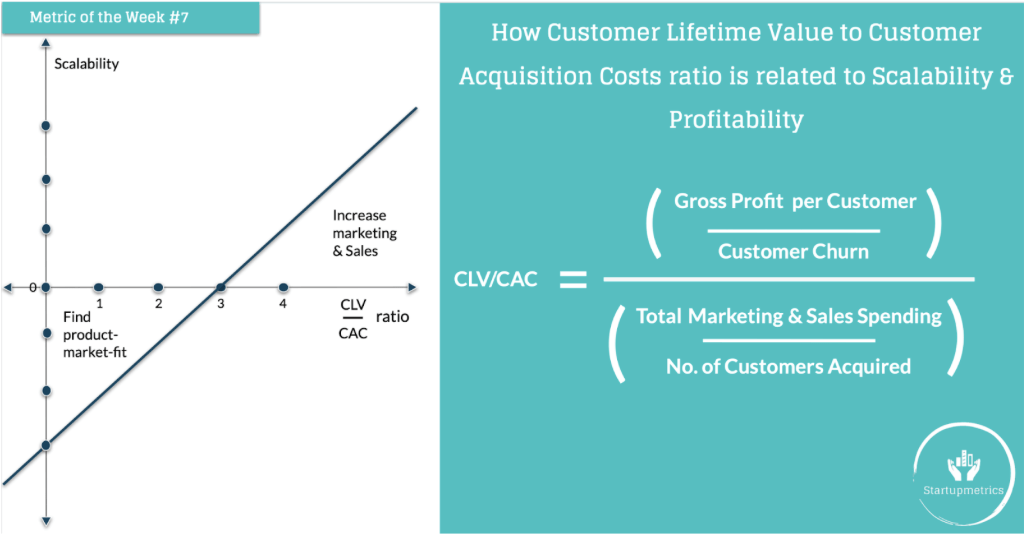

- Customer acquisition costs

- Pricing

- Net retention rate

- Variable production costs

- R&D expenses

- Operational expenses

- Working capital requirement

-

TV

- Revenue at time of exit

- Industry-specific valuation multiples

-

r

- Return expectation according to perceived market and company-specific risks