What does a startup CFO do? – And what are a startup’s CFO’s responsibilities?

Lack financial and other relevant skills required to run a startup or spin-off successfully. Lack of skill set results in…

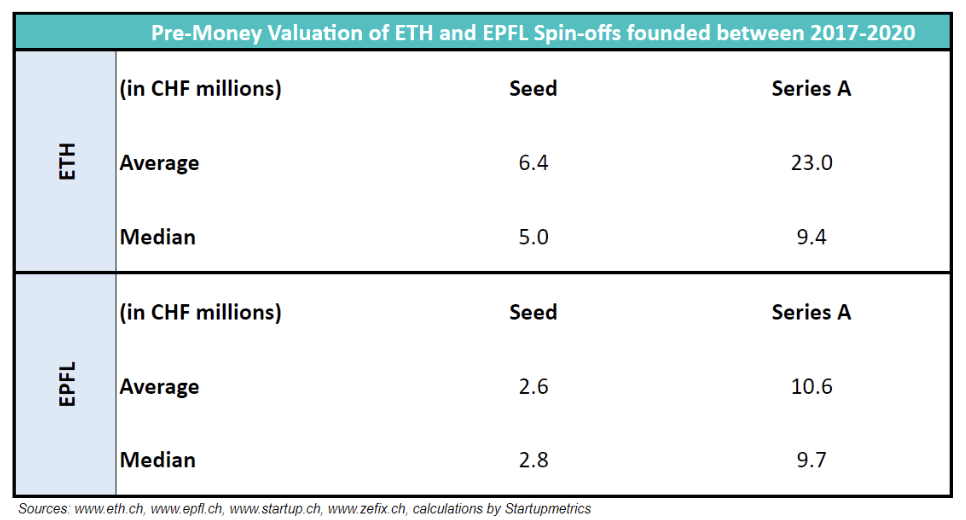

The valuation of pre-revenue start-ups requires a specific data set with comparable transactions. Differences in qualitative factors such as team strength and market potential justify a deviation from the mean. In this post, we briefly discuss the average and median pre-money valuation of early-stage spin-offs from the two top Swiss universities, ETH and EPFL.

The average pre-money valuation in the seed phase is CHF 6.4 million and CHF 2.6 million for ETH and EPFL spin-offs, respectively. The corresponding median value is 5 million CHF and 2.8 million CHF. Thus, the pre-money valuation of an ETH spin-off in the seed stage is likely to be 78% to 146% higher than that of an EPFL spin-off. Moreover, the distribution is skewed to the right. This means that the majority of spin-offs are valued below their average.

The average pre-money valuation of the Series A spin-offs also differs significantly. On average, the pre-money valuation of ETH spin-offs is 116% higher at CHF 23 million compared to CHF 10.6 million. However, the median pre-money valuation of the Series A spin-offs of the two universities is comparable with a deviation of only 3.39%.