How do startups and spin-offs benefit from business monitoring & controlling system?

Economic research reveals that business monitoring and controlling systems have a positive impact on the business growth of startups….

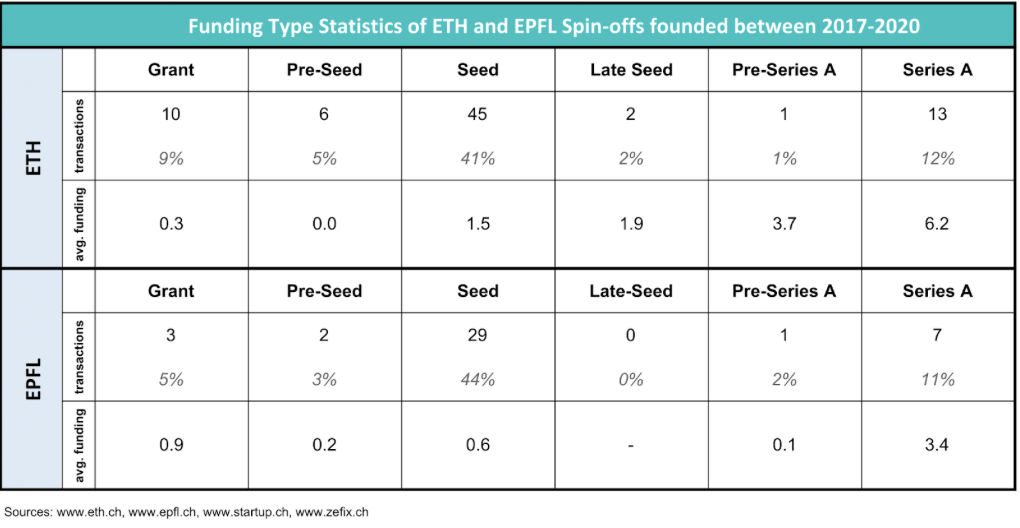

Well-funded startups grow faster compared to bootstrapped ones. What type of funding did the ETH and EPFL spin-offs launched between 2017 and 2020 receive so far? What can you do to increase your probability of being well-funded?

The majority, namely 41% of ETH and 44% of EPFL spin-offs, raised a seed round. The average funding amount was CHF 1.5 million and CHF 0.6 million for the ETH spin-offs and EPFL spin-offs, respectively.

The second most common type of funding is Series A. Of the cohort studied, 12% of ETH spin-offs and 11% of EPFL spin-offs received this type of funding. Similar to the seed round, spin-offs in the German-speaking part received a significantly higher amount on average, namely 6.2 compared to 3.4 million CHF.

Further, the likelihood of a spin-off receiving some form of grant is higher relative to all spin-offs launched if it is an ETH spin-off. However, the average amount for grants seems to be higher in the French-speaking part, but this observation might be biased due to the small data set in this category.

If you are in the seed phase, focus on the following points to make your spin-off appear more attractive to investors:

Once you’re past the seed stage, it’s about finding product-market fit. Investors will invest larger sums in your company once they are convinced that you can scale your business with reasonable unit economics. You will find a simple but effective process to find product market fit in our previous blog post: find product market fit