What do your financial statements say?

Your financial statements show your company’s performance and ability to generate value for you and your stakeholders. Types of financial…

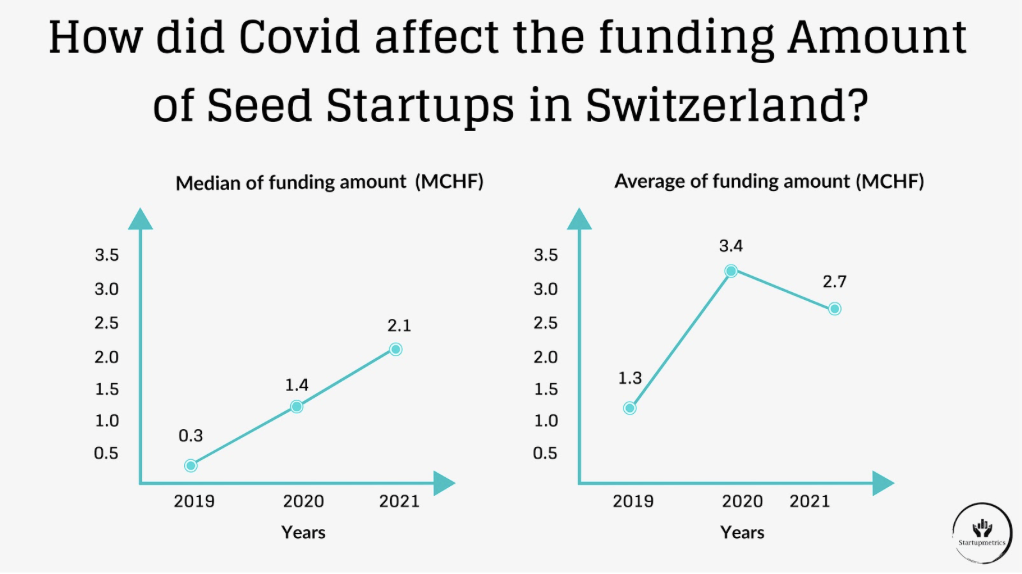

Switzerland seed startups experienced a positive trend in the amount of funding despite Covid-19 but were most likely negatively affected by the time required for fundraising. The observed median and average funding amount in 2020 and 2021 was higher than in 2019. While preparing the graphs, we assessed 142 seed investments and discovered that,

We expected that the average and median funding amount would decrease in comparison to 2019. But, it increased and we observed a positive trend in 2020 and 2021. We also observed that in this pandemic the time required for fundraising increased, which is a negative effect. But on the other hand, the average and median funding amount increased. Which is a positive effect on Swiss startups. Hence, we can come to the conclusion that the future of Swiss startups/spin-offs is on the bright side.